2025 1st Quarter Client Letter – Portfolio Strategy for an Uncertain Policy Environment

By Will Klein, CFA

Quarterly Investment Commentary

Tariffs, Turbulence, and the Value of Portfolio Diversification

These last three months have been a turbulent period for investors. In January, the Chinese DeepSeek AI breakthrough triggered a selloff in domestic AI focused tech stocks. Then, in February, March, and April the Trump administration announced a series of tariffs on US trade partners. Those tech and trade policy developments pushed the S&P into a correction over the first quarter, with the index falling 10% from February 19th to March 13th. Equities have remained volatile into early April, as additional tariffs rattled global markets.

While those developments have roiled markets, it is important to look at this equity correction in context: 10% market corrections are actually normal. Over the last 50 years, we have averaged roughly one correction every two years. Additionally, last quarter’s correction came on the heels of a rapid bull market, with the S&P returning more than 25% in both 2023 and 2024. In that light, this pullback could be viewed as a healthy consolidation period. Lastly, while tariff hikes threaten economic growth, we do not see signs of an imminent recession that would trigger a prolonged bear market today.

Recent turbulence also highlights the value of portfolio diversification: Fixed income has provided a ballast to equities during this recent market volatility and should continue to insulate portfolios from recession risks while also offering healthy mid-single digit yields. Real Assets provided similar insulation, with listed Real Estate Investment Trusts (REITs), precious metals, and infrastructure stocks all ending the quarter in positive territory. Lastly, alternatives including private credit and insurance-linked securities have so far been unimpacted by recent macro and market shocks. As a result, we are optimistic that our allocations in these diversified asset classes will continue to deliver stable returns despite policy and market uncertainty. Looking ahead, we are maintaining our strategic asset allocation stance in the face of today’s macro and policy risks. However, we will continue to look to fixed income, alternatives, and real assets to maintain balance through this uncertain environment.

1Q25 Market Performance

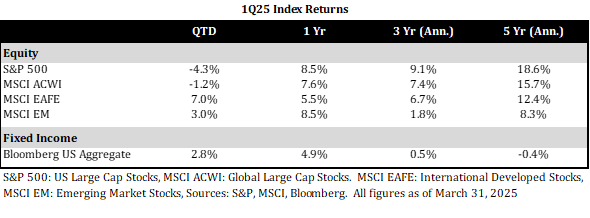

While US equities struggled over the first quarter, international stocks delivered stronger returns. That performance was driven by a reversal in recent dollar strength and renewed optimism around Chinese and European fiscal stimulus. However, that reconvergence in regional equity market returns was relatively modest. Over the past twelve months, U.S. equities have still slightly outperformed international markets, and over longer periods, their performance lead remains substantial. While we are not convinced that regional rotation will have staying power, we are monitoring the drivers of that potential regime shift.

Meanwhile, core fixed income generated solid 2.8% returns over the quarter. Within fixed income, longer-duration investment grade bonds, which benefited from falling interest rates, led. At the same time, high yield bonds lagged as policy risks loomed for lower quality borrowers. Therefore, our quality focus within core fixed income helped through that environment.

Conclusions

While recent market volatility has affected client portfolios, we remain confident that our portfolio construction framework will help clients weather this turbulence. Briefly outlining that framework, US equities represent the largest allocation and most impactful performance driver for most clients. While that focus could contribute to short-term volatility amid policy uncertainty, we are still confident in the strategic case for US stocks. More specifically, we believe the abundance of growing, innovative, well-managed businesses here in the US makes the US equity markets the best pond to fish in. We are optimistic our investment approach, which stresses business stability and through-cycle earnings growth potential, should add value if we enter a more challenging market environment.

Beyond equities, we believe allocations to fixed income, alternatives, and real assets, can play a key role in stabilizing portfolios through volatile periods. Recent moves, including investments in alternatives like private credit, reflect that conviction. As always, we are optimistic that approach will help portfolios weather any additional macro or market shocks. Please reach out with any questions about your portfolio or our market outlook.