2024 3rd Quarter Client Letter –Balanced Portfolios and the Fed’s Pivot

By Will Klein, CFA

Quarterly Investment Commentary

Fixed Income after the Fed’s Pivot

The summer is typically a quiet period for the markets. Bankers and traders go on holiday, trading volumes lull, and equity returns can be sluggish. That history of summer doldrums inspired the old adage “sell in May and go away, come back on St. Ledger’s Day.”

The last three months have been an exception to that rule, as investors navigated a brief bout of intense market volatility in August, a Federal Reserve interest rate cut in September, and strong market returns through the full 3rd quarter. Those developments highlighted important macro and market dynamics. For instance, the early August equity market drawdown, which was triggered by a Bank of Japan rate hike, showed how US stocks are exposed to instability in the international financial system. Meanwhile, the Fed’s decision to cut the Fed Funds rate from 5.25% to 4.75% in September highlighted how moderating inflation has given the Fed room to respond to slowdown scares by easing financial conditions. Most importantly, those events underscored a shift in the relationship between stocks and bonds. Over the last three months bonds did something they haven’t reliably done in years: They acted as a ballast against equity market volatility.

Until recently, the diversifying relationship between stocks and bonds was the norm. For most of the last 20 years, whenever economic growth stalled and stocks struggled, the Fed cut rates, bonds climbed, and fixed income gains helped to offset equity losses. However, the inverse relationship between those core portfolio building blocks broke down in 2022 as hot inflation and Fed rate hikes pushed stocks and bonds lower in lockstep. Our focus on short duration bonds within clients’ fixed income portfolios, alongside our allocations to real assets and alternatives, has insulated clients’ portfolios from those headwinds at the margins. With inflation stabilizing below 3% and the Fed cutting rates, we’re optimistic bonds will once again play the role of a ballast to clients’ equity portfolios. However, trade tensions or energy market disruptions could upset this moderate inflation equilibrium. So, while we’re growing more constructive on the diversification benefits of bonds, we believe that other portfolio building blocks, like alternatives including hedge funds and private credit, and real assets including real estate, infrastructure, and commodities, still have a key role to play in driving returns and maintaining diversification today.

3Q24 Market Performance

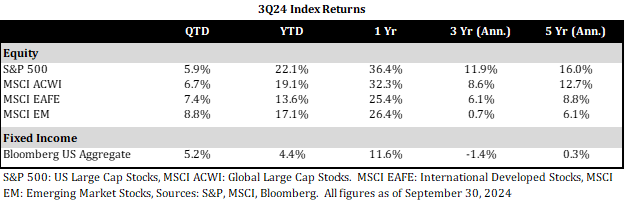

Despite brief bouts of volatility concentrated in Japanese stocks, Chinese stocks, and US tech stocks, equity markets delivered broadly healthy returns over the 3rd quarter, with the MSCI All Country World Index returning 6.7% over the last three months.

That strong global equity market performance was driven by a broadening out of market leadership, as stocks outside of the tech sector began to catch up with the marquee tech stocks that led markets higher over the first six months of the year. That being said, the longer-term trend of a few tech names driving global markets is still very much in place. We’re optimistic our balanced approach to equity portfolio construction — which involves owning tech leaders like Microsoft and Apple, alongside high-quality growing businesses outside of that large tech company cohort like Costco and Visa — will mitigate risks in this uncertain market leadership environment.

Meanwhile, core fixed income delivered strong 5.2% returns over the 3rd quarter, powered by moderating inflation and Fed rate cuts. While bond markets remain volatile, the Fed’s rate cuts should support continued healthy returns and diversification benefits from that portfolio building block. Additionally, we expect our allocations to Treasury Inflation Protected Securities (TIPS) within fixed income to help insulate clients from upside risks to inflation and interest rates should that outlook change.

Cross-Asset Outlook

For over a decade, our tilt towards large cap US stocks within clients’ equity portfolios has been a key driver of long-term returns. That US-focus could contribute to portfolio volatility over the next three months due to uncertainty around upcoming elections. As research from JP Morgan shows, we have historically seen an increase in overall US market volatility around presidential election cycles over the past 20 years. However, despite the potential for short-term market volatility, we remain constructive on the strategic case for US equities. At a macro level, we believe America’s dynamic, fast growing economy is positive for US stocks. At a security-selection level, we believe the abundance of growing, innovative, well managed businesses here in the US makes the US equity markets an attractive pool to fish in. Therefore, while we will continue to monitor the policy stakes of this election, including the expiration of the 2017 Tax Cuts and Jobs Act to the future of US/China trade tensions, we don’t plan to alter our US equity positioning.

Conclusions

Core US equities continue to perform well, powered by resilient economic growth and healthy corporate earnings. Meanwhile, core investment-grade fixed income is once again adding value, delivering healthy yields and providing a ballast to equities during periods of market volatility. While we remain constructive on those core equity and fixed income allocations, we’re optimistic that investments across other asset classes like real assets and alternatives will continue to represent valuable complements to those core allocations. We continue to look for opportunities to diversify around those core portfolio building blocks where appropriate.

As always, do not hesitate to reach out if you have any questions about these themes or your portfolio.