2023 2nd Quarter Client Letter – A Tale of Top-Heavy Markets

By Will Klein, CFA, Kaitlyn Fagundes

Quarterly Investment Commentary

Navigating This Narrow AI-Driven Equity Market

US equities have defied recession fears and bank collapses to deliver impressive returns over the first half of 2023, with the S&P 500 ending June with a year-to-date (YTD) gain of 16.9%. However, this year’s strong market returns have not been evenly distributed. Instead, this equity market rally has been historically top heavy, with seven large tech and tech-adjacent companies—Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, and Tesla—powering over 70% of the S&P’s returns. In contrast, the remaining 98% of the stocks in the S&P have delivered a more modest 4.5% return over the first half of this year.

We attribute that narrow leadership to two factors. Firstly, this year’s tech leaders benefited from macro tailwinds as inflation and interest rates stabilized, supporting a rotation into less cyclical companies. Secondly, these tech companies have ridden a wave of demand for new machine learning tools like generative artificial intelligence (AI) and large language models. Burgeoning AI demand has bolstered the fortunes of semiconductor designers like Nvidia, which sells the silicon that powers most large AI models, and cloud computing leaders like Amazon, Microsoft, and Google, which are poised to grow with this disruptive new technology.

Some strategists have raised concerns about this narrow market leadership, drawing parallels to previous concentrated bull markets like the Dotcom boom of the late 1990s, and arguing that top-heavy markets are prone to toppling over. However, today’s market leaders like Apple and Microsoft are fundamentally healthier than the tech leaders of the late 1990s. As such, we believe those comparisons are overblown, and we will continue to own high-quality tech leaders with wide competitive moats, long growth runways, and leverage to thematic growth drivers like AI.

While we continue to favor tech leaders, we are using this environment opportunistically and adding to out-of-favor cyclical stocks and defensive stocks at the margins. We are optimistic that our balanced approach to portfolio construction will help if AI innovations prove as transformative as proponents hope, while providing diversification if equity market leadership shifts.

2Q23 Market Performance

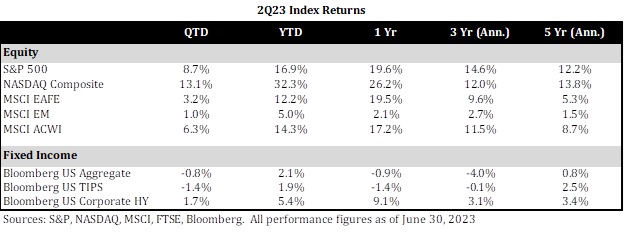

While US equities benefited from strong tech sector returns year-to-date, international equities had more mixed results as emerging markets struggled. Meanwhile, fixed income performance was steady, as inflation continued to fall as shown below:

Given that environment, our US focus was rewarded. Moreover, fixed income’s stable returns once again demonstrated the case for allocating to the asset class after a volatile 2022.

Cross-Asset Outlook

While this AI-powered equity market rally has captured more media attention, the recent shift in fixed income markets has been similarly noteworthy. After a challenging 2022, when soaring interest rates pushed core fixed income markets to their worst calendar year returns since the 1970s, interest rates appear to be stabilizing and recent comments from Federal Reserve officials support that analysis. Fed leaders like Jerome Powell have signaled that, with the Fed Funds rate currently at 5.25% and inflation on a downward trajectory, we are entering the late innings of this interest rate hiking cycle.

Our focus on short duration bond managers has helped through this rate hiking cycle. Specifically, our allocations to cash, short-term treasury bills, and credit managers focused on shorter duration bonds insulated portfolios from the impact of rising rates through 2022. However, with interest rates stabilizing and bond markets offering some of their healthiest current income in over a decade, we are starting to capitalize on opportunities within intermediate term bonds. Those securities should allow investors to lock in healthy returns if slowing growth and slowing inflation push interest rates lower, while providing ballast to equity portfolios in a recession scenario.

Equity Strategy Highlight

While we invest in several companies that are poised to benefit from today’s Cambrian explosion of AI models, perhaps no portfolio company is more closely linked to this AI boom than Microsoft (MSFT).

Microsoft’s AI leadership stems from its relationship to OpenAI, the startup behind the ChatGPT large language model. Microsoft first invested $1B in OpenAI in 2019 and made an additional $10B investment in the startup this year. Those deals cemented strong links between the two groups. OpenAI’s models have been developed on Microsoft’s Azure supercomputers since 2019 and now power Microsoft products like its GitHub copilot and its Bing chatbot. Additionally, Microsoft is working to integrate OpenAI’s capabilities into its flagship productivity software suite through its Microsoft 365 Copilot program. That project, which will involve selling subscriptions for AI plugins for programs like Excel, Outlook, and Word, should present a significant growth opportunity for this tech leader.

Microsoft’s AI leadership is not an accident. While the Washington based software developer has a popular reputation as the sleeping giant of the tech sector, its CEO Satya Nadella has spent the last nine years reinventing the company by using its dominant position in mature software businesses to expand into faster growing tech markets. Specifically, Nadella has leveraged Microsoft’s commanding competitive position in PC operating systems, server operating systems, and productivity hardware to build its Azure cloud hosting platform and its Defender cybersecurity platform. The value proposition for those services—they come from a trusted partner and play well with widely used programs like Excel, Outlook, and Microsoft SQL—has helped Microsoft overtake smaller, more dynamic peers to become a leading player in tech’s fastest growing markets.

That ‘Empire Strikes Back’ dynamic was core to our investment thesis when we first added Microsoft to portfolios almost seven years ago. Since then, Microsoft’s consistent execution around harnessing new technology trends like AI and cloud computing have increased our conviction in that thesis. And today, the group’s strong management team and wide competitive moat should continue to support value creation through the business cycle. So, while we will continue to monitor the valuation and size of our investment in the company, we believe Microsoft will remain an attractive core tech holding long term.

Conclusions

This year’s narrow equity market leadership has proved a tricky environment for investors, with just a few stocks driving much of the market’s returns. We are optimistic our exposure to established, high quality tech leaders with leverage to thematic growth drivers like AI will continue to help in this environment. That being said, we are opportunistically rebalancing into out-of-favor cyclical stocks, defensive stocks, and other diversifiers at the margins.

Bigger picture: our strategic perspective is unchanged. We continue to believe US equities represent an attractive core allocation for long-term investors. Moreover, we believe investment grade fixed income offers competitive yields and diversification benefits today. We will continue to augment those core allocations with investments in cash, real assets, and alternatives, where appropriate.

Please do not hesitate to reach out if you have any questions about these market themes or your portfolio.