2024 4th Quarter Client Letter – Another Year of American Exceptionalism

By Will Klein, CFA

Quarterly Investment Commentary

Narrow Market Leadership and the Dominance of US Tech

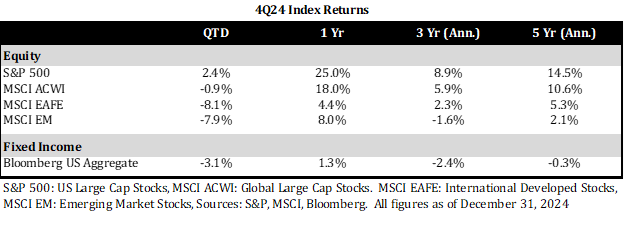

Large Cap US Equities delivered strong returns in 2024 with the S&P rising 25%, significantly outpacing international equities. Meanwhile, emerging market stocks (MSCI EM Index) posted modest 8% gains and international developed stocks (MSCI EAFE Index) returned an anemic 4%. That gap was nothing new. US equities have consistently outpaced international stocks since the Great Recession, averaging 14% annual returns compared to 5% annual returns for international markets since 2009. The decoupling between the US and the rest of the world has left investors with two questions: What’s driving this extended period of American exceptionalism? And can it last?

We believe that a couple of forces have driven this long run of US outperformance: Firstly, at a macro level, the US’s dynamic, growing economy has created a consistent tailwind for US stocks. Secondly, at a company level, US businesses have often been managed effectively, shown innovation, and maintained competitiveness compared to international peers These factors may continue to support US corporate earnings growth and US equity returns long term. More narrowly, however, it is impossible to tell the story of recent US exceptionalism without focusing on the dominance of a handful of large US tech stocks: In 2024 alone, just 8 tech and tech-adjacent stocks drove ~60% of the market’s returns. It has also been true longer term: Over the last 15 years US tech juggernauts like Apple, Amazon, Microsoft, and NVIDIA have powered an outsize share of US market gains by becoming global leaders in new industries like smartphones, ecommerce, cloud computing, and AI.

Our domestic focus within clients’ equity portfolios has put us on the right side of that US leadership regime. However, our balanced approach to US equity investing—tilting towards more tested and less cyclical businesses—was an offsetting detractor over 2024, limiting our exposure to last year’s tech leaders. Looking ahead, we will continue to favor US equities in clients’ portfolios while maintaining a diversified approach, allocating to thematic winners in fast-growing industries like cloud computing and AI while also focusing on opportunities in less loved sections of the market. That approach should help clients capture returns from this American Exceptionalism theme, while mitigating risks associated with narrow market leadership.

4Q24 Market Performance

Last quarter, market performance was driven by two major developments: The November election and the December Fed meeting.

Republicans’ presidential and congressional victories in November drove regional dispersion. US stocks led as markets responded to the prospect of tax cut extensions, which could boost household incomes and corporate earnings. Meanwhile, international stocks lagged as markets reflected the risk that higher tariffs could squeeze export-driven economies in Europe and Asia. Lastly, both the election and the Fed meeting drove rates higher, as markets priced in the impact of trade wars and tax cuts. Fed Chair Powell gave credence to those concerns in his December press conference, when he adopted a cautious stance around 2025 rate cuts, while calling out tariff risks to his inflation outlook.

Those developments underscored two broader related trends: deglobalization and inflation uncertainty. Those themes are incorporated into our strategic outlook. So, while we didn’t make tactical portfolio adjustments around the election or the Fed meeting, client portfolios were positioned to weather the resulting market rotations.

Those developments underscored two broader related trends: deglobalization and inflation uncertainty. Those themes are incorporated into our strategic outlook. So, while we didn’t make tactical portfolio adjustments around the election or the Fed meeting, client portfolios were positioned to weather the resulting market rotations.

Conclusion

Core US equities drove portfolio performance over 2024, bolstered by resilient economic conditions and robust corporate earnings growth. Core investment-grade fixed income, meanwhile, delivered lackluster returns last year. However, we continue to see a case for fixed income today, given the bond market’s competitive yields and potential diversification benefits.

Looking beyond those equity and fixed income building blocks, we’re also optimistic that investments across real assets and alternatives will continue to represent valuable complements to those core allocations. Recent allocations to alternatives managers, including private credit funds, underscore our conviction there. We will continue to look for opportunities to diversify around those core equity and fixed income portfolio building blocks when they align with our strategic views and client needs.

As always, please reach out with any questions about your portfolio or our market outlook.