2024 2nd Quarter Client Letter – Continued Market Strength, and a Shift in the Consumer Climate

By Will Klein, CFA

Quarterly Investment Commentary

Taking the Temperature of the US Consumer

Two years ago, most economists and investment strategists believed the US was careening towards a recession. Macro and market indicators, like the ISM Purchasing Managers’ Index and the slope of the yield curve, suggested companies and investors were bracing for an economic crash, and the consumer spending outlook was similarly grim. Today, the situation looks very different: Federal Reserve data shows the US economy grew at a healthy 2.5% rate over 2023 and appears on track to grow at a similarly robust clip through 2024. Resilient consumer spending, which makes up 68% of the economy, played a key role in helping the US avert that much anticipated recession.

With recession risk now fading, it’s a good time to reassess the health of the US consumer. Most gauges for US consumer spending appear strong. For instance, Visa saw US payment volumes increase ~5.6% year-over-year last quarter. However, we’re seeing a growing divide between the haves and the have nots, as higher-income households continue to spend more, but lower-income households cut back. That is clear from the credit card data, with credit card delinquencies climbing back to their pre-COVID averages for lower credit score borrowers. It’s also playing out across our portfolio companies. Marriott, for example, is reporting softer bookings across budget hotels as lower-income households pare back on summer travel. Meanwhile, Costco, which primarily sells to middle- and upper-income households, is seeing healthy revenue growth but Dollar General, which we don’t own, is struggling as its lower-income customers tighten their budgets.

That tale of two consumers has a limited impact on our market outlook. In 2023, BCA Research estimated the bottom 20% of American earners accounted for just 9% of total consumer spending. Demand from higher-income households, boosted by record home equity and strong stock market returns, is expected to balance out weaker spending across that lower-income cohort.

We are confident that our focus on quality investments should protect client portfolios from this trend. Across clients’ equity portfolios, our tilt towards less cyclical businesses has led us to limit our exposure to retailers and lenders that over-index to lower-income consumers. Similarly, in clients’ fixed income portfolios, our focus on safe credits means we’re not exposed to sub-prime consumer loans. Therefore, we believe client portfolios are positioned to weather this bifurcation in household spending. We will continue to monitor that trend and what it means for portfolios.

2Q24 Market Performance

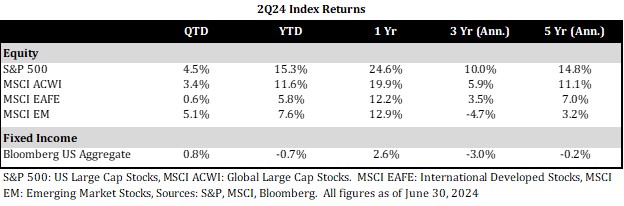

While some consumer stocks struggled last quarter, markets continued to climb, with the S&P trading 4% higher over the last 3 months. That strong market performance was driven by a few large tech leaders, furthering the trend of narrow tech sector leadership. Over the last 12 months the NASDAQ Composite, which skews towards fast growing tech stocks, returned 30%, while the Dow Jones Industrial Average, which skews towards mature “old economy” companies, returned 16%. That dynamic also contributed to the continued outperformance of US stocks over international markets, with the S&P returning 25% to the MSCI All Country World Ex US’s 12% over the last 12 months.

Meanwhile, fixed income has delivered lackluster returns as interest rates and inflation have remained elevated. While persistent ~3% inflation could limit the Fed’s ability to ease financial conditions this year, the Fed is still on track to cut rates from their current ~5.25% level by the end of 2024. Additionally, our allocations to Treasury Inflation Protected Securities (TIPS) within fixed income should help insulate clients from upside risks to inflation and interest rates if that outlook changes.

Conclusions

Investors have benefited from strong equity market returns since the end of 2022. Our large cap US equity focus has helped clients participate in that recovery. However, this bull market has been historically narrow, with just ten stocks driving over two thirds of the S&P’s returns over the last 18 months. That narrow rally has made for a challenging investing environment. While we own many of the tech leaders that are driving markets higher today, we are also working to balance that exposure with investments in high quality, growing businesses across other sectors. We continue to believe our balanced exposure across large cap US equities will add value and limit risk through the cycle.

We are also optimistic that investments across other asset classes, such as small cap US stocks, emerging market stocks, and high-quality fixed income, can deliver value if this leadership regime broadens out. We also continue to look for opportunities to diversify around those core equity and fixed income portfolio building blocks with allocations to cash, real assets, and alternatives where appropriate.

As always, do not hesitate to reach out if you have any questions about these market themes or your portfolio.