2023 1st Quarter Client Letter – It’s A Wonderful Life

By Will Klein, CFA, Kaitlyn Fagundes

Quarterly Investment Commentary

A Banking Crisis, Not a Credit Crisis

The failures of Silicon Valley Bank (SVB) and Signature Bank last month prompted comparisons to the Global Financial Crisis (GFC). However, pictures of depositors lined up outside SVB also call back to an older, fictional banking crisis: the bank run at Bailey Building and Loan in the 1946 Christmas classic It’s a Wonderful Life. In that movie, James Stewart confronts a group of panicked depositors planning to pull their cash from his small community bank. His impassioned speech stems that tide of withdrawals, and Bailey Building and Loan survives the crisis with $2 to spare, but the scene illustrates how vulnerable banks can be to crises of confidence.

SVB and Signature were much bigger and more complex than Bailey Building and Loan, but their collapses have been more analogous to that textbook bank run than the failures of Washington Mutual and Countrywide in 2008. The 2008 GFC was a credit crisis. Banks made bad loans, households took on too much leverage, and the most aggressive lenders suffered significant permanent losses. In contrast, SVB and Signature suffered an interest rate crunch. Climbing interest rates weighed on the values of the banks’ ostensibly low risk bond portfolios. Without a bank run, they likely could have waited out those losses as bonds matured. Instead, depositors rushed for the exits, pushing the banks into receivership.

That distinction between a credit crisis and a banking crisis has important macro and market implications. Recent bank failures do not signal that American households and businesses are overleveraged like they were in 2008. Moreover, regulations put into place since the GFC should limit contagion risk at the largest US banks. So, while banking system stress will likely weigh on credit creation in the near term, that challenge is more consistent with a cyclical recession than a structural deleveraging like investors had to navigate in 2008. These recent bank failures could also have a silver lining for investors as they could bring forward the end of this rate hike cycle as the Fed works to stabilize the financial system. That informs our market outlook.

While we still believe high quality, large cap US equities represent an appropriate core allocation for most clients, we continue to be more constructive on fixed income. Bonds offer some of their highest yields in over a decade and slowing growth drives a more balanced outlook for interest rates. Moreover, we continue to diversify around those portfolio building blocks with allocations to asset classes like cash, real assets, and alternatives, where appropriate.

1Q23 Market Performance

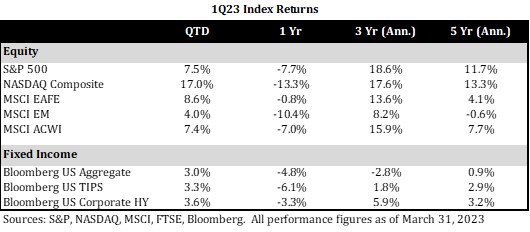

Global equity markets proved resilient to bank closures through the first quarter:

That resilience highlighted the case for diversification and balanced sector exposure across equity portfolios. Meanwhile, as markets priced in growing recession risk, core fixed income, measured using the Bloomberg US Agg, delivered its strongest quarterly returns since inflation began to climb in the 2nd quarter of 2020. That reversal underscores how fixed income can play a role in helping portfolios weather acute growth shocks like bank failures.

Equity Strategy Highlight

Prior to their collapse, SVB and Signature were among the fastest growing US banks, growing their balance sheets 198% and 118% from 2019 to 2022, respectively. Their rapid reversal of fortune is in keeping with a bigger theme. To quote management theorist Peter Drucker, “In every major economic downturn in US history, the villains have been the heroes during the preceding boom.” This pattern held true after the Dotcom boom of the 1990s, it held after the housing boom of the 2000s, and it is proving true of the 2010s tech boom today. Digital transformation leaders, which led markets higher over the last decade, are increasingly becoming the villains of this bear market. We have positioned around that regime shift by selectively adding to higher quality old economy names. However, we still believe in some digital transformation themes, and will continue to hold stocks geared to those long-term trends.

One such holding is Visa (V), the global payment network. The group was founded by Bank of America in 1958 as an internal credit card technology project. It spent its first 50 years as an appendage of credit card issuing banks—first just BofA, then a collection of banks that used it as a shared card network. In 2008 it went public as a standalone company. Today, 15 years after that IPO, it is the largest and most profitable payment provider in the world due to the ~0.25% fee it earns on the upwards of $10 trillion in payments that move across its network each year.

Visa’s growth has been driven by a couple of structural tailwinds. Firstly, Visa benefits from payment digitization as consumers increasingly favor cards over cash: Fed surveys show cash’s share of US consumer payments fell from 28% to 19% between 2010 and 2020. Secondly, Visa benefits from the rise of ecommerce as it earns higher fees on those card-not-present transactions. Census Bureau estimates show ecommerce sales have climbed from under 5% of addressable US retail sales in 2010 to over 12% of retail sales in 2020. These payment digitization and ecommerce trends should continue to drive growth for the company in the long term.

Furthermore, Visa performs well across quality and environmental, social, and governance (ESG) criteria. Its unparalleled network of card-issuing and merchant-acquiring banks represents a wide competitive moat. Its growth model is very capital light, positioning management to return most of the cash the business generates to shareholders via dividends and buybacks. Moreover, the company has been proactive in managing data security, it has cut its environmental impact by investing in renewable energy power purchase agreements, and it is a key sponsor of financial literacy and inclusion campaigns in emerging markets.

Visa’s gearing to secular growth trends, wide competitive moat, and ESG leadership should continue to support value creation through the cycle. So, while most digital transformation leaders are currently out of favor, we believe this company will remain an attractive core financials holding long term.

Conclusions

Last quarter’s bank closures underscore the unpredictability of the current market environment. Moreover, there are plenty of other risks—from debt ceiling brinksmanship to geopolitical conflict—on the horizon. However, we continue to believe investors will be rewarded for staying the course through turbulent markets.

We believe high quality US equities should continue to drive portfolio returns over the long term. Similarly, we believe investment grade fixed income’s competitive yields demonstrate its value as a portfolio building block today. Lastly, we will continue to diversify around those core allocations with asset classes including cash, real assets, and alternatives, where appropriate.

Please do not hesitate to reach out if you have any questions about your portfolio or our market outlook.